Oasdi Limit 2025 Wage Base Period - What Is The Oasdi Limit For 2025 Renie Delcine, Oasdi tax, also known as social security tax, is collected from paychecks to fund the social security program. In 2025, this limit rises to $168,600, up from the 2023. Oasdi Max 2025 Catie Bethena, This amount is also commonly referred to as the taxable maximum. Only withhold and contribute social security taxes until an employee earns above the wage.

What Is The Oasdi Limit For 2025 Renie Delcine, Oasdi tax, also known as social security tax, is collected from paychecks to fund the social security program. In 2025, this limit rises to $168,600, up from the 2023.

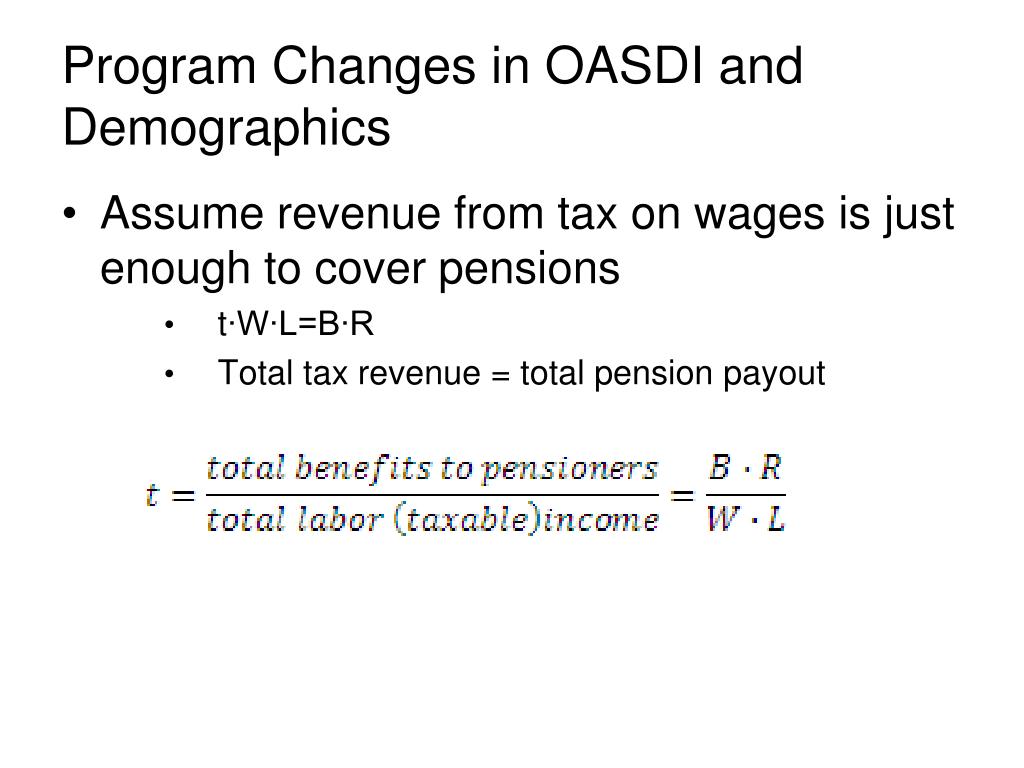

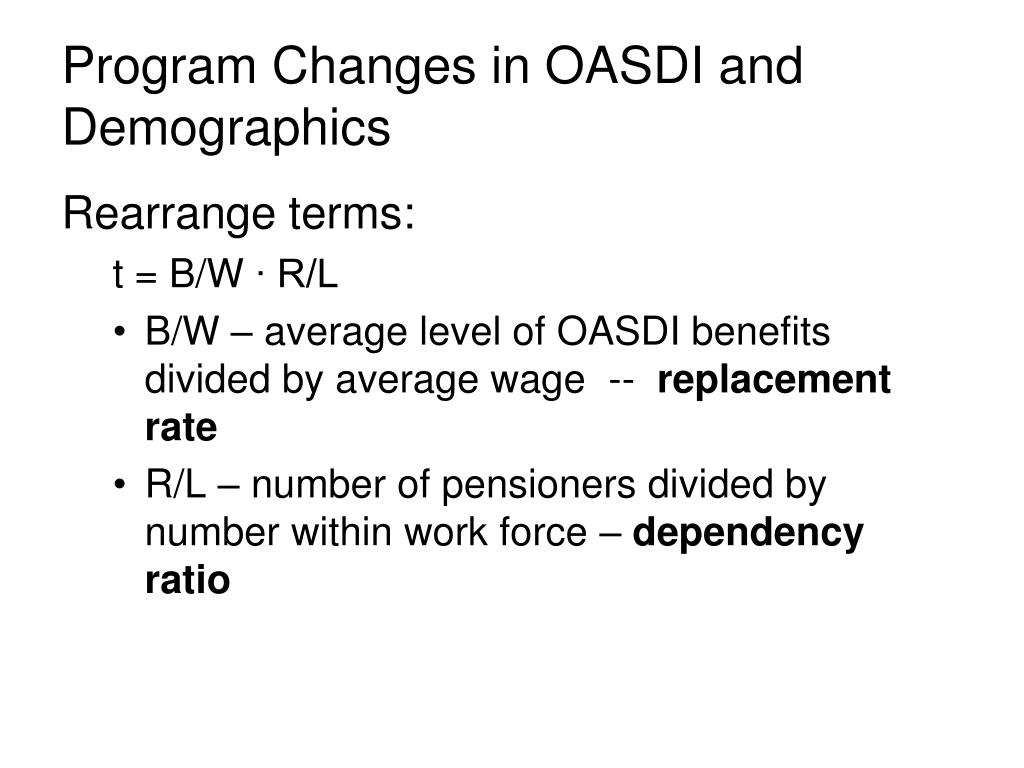

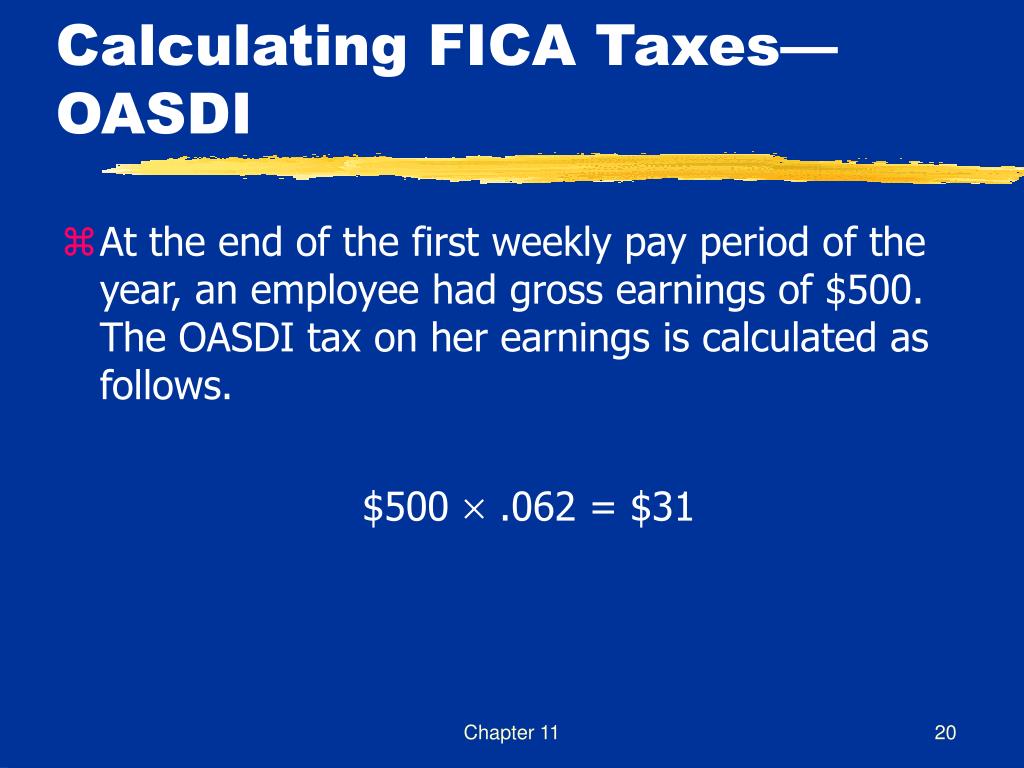

Which tax does not have a wage base limit? OA. FICAOASDI OB. Federal, The maximum social security employer contribution will increase by $520.80 in 2025. Oasdi and medicare taxes are calculated as follows:

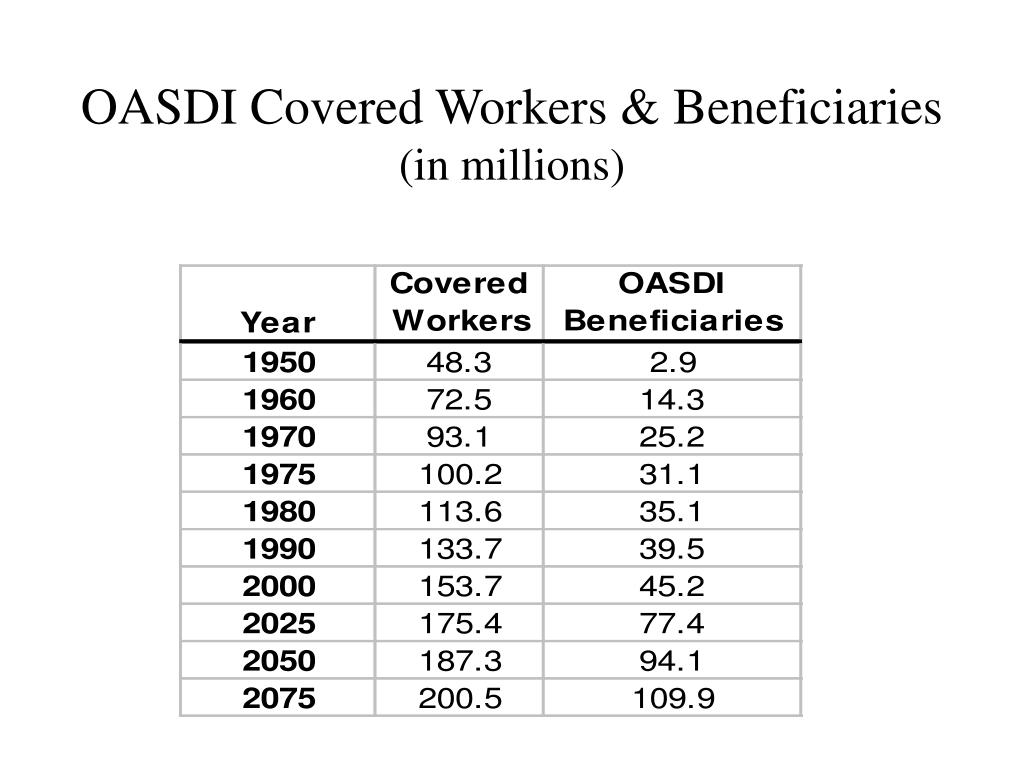

PPT Social Security PowerPoint Presentation, free download ID1428763, For earnings in 2025, this base is $168,600. As the union budget approaches, many indians are expressing a desire for changes in income tax rates amidst rising.

Takeda Help At Hand Limits 2025 Deeyn Evelina, As the union budget approaches, many indians are expressing a desire for changes in income tax rates amidst rising. The amount, an increase from $160,200 in 2023, is the wage base limit that applies to earnings subject to the 6.2% oasdi tax (old age, survivors, and disability.

Oasdi Limit 2025 Wage Base Period. In 2025, this limit rises to $168,600, up from the 2023. For 2025, the oasdi tax rate is set at 6.2% of net earnings for social security coverage and 1.45% for medicare coverage (a total of 7.65%).

PPT Social Security PowerPoint Presentation, free download ID1428763, The oasdi limit, or social security wage base, acts like a ceiling on earnings subject to that familiar social security tax we all love to hate. Method for determining the base the formula for determining the oasdi contribution and benefit base is set by law.

Oasdi tax, also known as social security tax, is collected from paychecks to fund the social security program. In 2025, this limit rises to $168,600, up from the 2023.

The maximum social security employer contribution will increase by $520.80 in 2025.

Oasdi Max 2025 Catie Bethena, Fast forward to 2023, and it’s $160,200. This amount is also commonly referred to as the taxable maximum.

PPT Employee Benefit Plans PowerPoint Presentation, free download, There are no longer two taxable wage bases. The oasdi taxable wages have a wage limit of $168,600 for the current.

PPT Chapter 11 PowerPoint Presentation, free download ID468444, What is the oasdi limit 2025? Only withhold and contribute social security taxes until an employee earns above the wage.